Get the free wisconsin tax exempt form

Show details

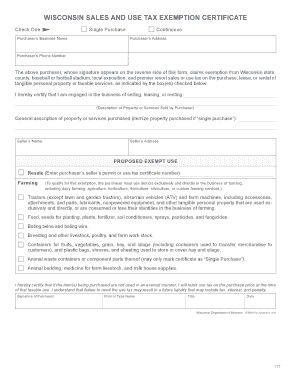

APPLICATION FOR WISCONSIN SALES AND USE TAX. CERTIFICATE OF EXEMPT STATUS (CES). WISCONSIN ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wisconsin sales tax exemption form

Edit your tax exempt form wisconsin form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wi tax exempt form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax exempt form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit wi sales tax exemption form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sales tax exempt form wisconsin

How to fill out tax exempt form pdf?

01

Start by downloading the tax exempt form pdf from the relevant website or source.

02

Open the pdf using a suitable pdf reader software on your device.

03

Review the instructions provided with the form to understand the requirements and eligibility criteria for claiming tax exemption.

04

Gather all the necessary information and documents that may be required to fill out the form accurately.

05

Begin filling out the form by entering your personal information such as name, address, and contact details in the designated fields.

06

Provide the required details about your organization or business, including its name, address, and tax identification number.

07

Indicate the specific reason for requesting tax exemption and provide any supporting documentation, if required.

08

Carefully review all the information entered to ensure accuracy and completeness.

09

Sign and date the form as required.

10

Make a copy of the completed form for your records before submitting it to the appropriate authority or department.

Who needs tax exempt form pdf?

01

Tax exempt form pdf may be required by individuals or businesses that meet specific criteria for tax exemption eligibility, such as non-profit organizations, charitable institutions, or government entities.

02

It is used to claim exemption from certain taxes based on the purpose or nature of the organization's activities.

03

Different countries or jurisdictions may have different requirements for obtaining tax exemption, and the use of a tax exempt form pdf helps streamline the process and provide the necessary documentation to support the claim.

Fill

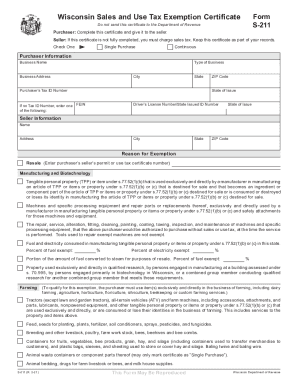

form s211

: Try Risk Free

People Also Ask about tax exempt form wi

What is the state of Wisconsin sales tax exemption form?

Wisconsin sales and use tax exemption certificate, form S-211. This is a multipurpose form which may be used for any Wisconsin sales and use tax exemption provided by law, except as provided in sub. (14). For direct pay, form S-211 may be used as the document described in s.

How do I get tax exempt in Wisconsin?

To apply for exempt status, the State of Wisconsin requires that you complete Wisconsin Department of Revenue Form S-211 (Wisconsin Sales and Use Tax Exemption Certificate). The effective date of the sales tax exemption is the date the form is signed. We cannot determine your taxable status.

How to fill out Wisconsin sales and use tax exemption certificate?

A fully completed certificate must include (1) the complete name and address of the purchaser, (2) general description of the purchaser's business (type of business), (3) reason for exemption, and (4) signature of purchaser unless the certificate is received electronically.

What is a Wisconsin sales and use tax exemption certificate?

Exemption certificates are signed by purchasers and are given to sellers to verify that a transaction is exempt. Sellers should exclude from taxable sales price, the transactions for which they have accepted an exemption certificate from a purchaser as described below.

What items are tax exempt in Wisconsin?

Sales Tax Exemptions in Wisconsin There are many exemptions to state sales tax. This includes, burial caskets, certain agricultural items, certain grocery items, prescription medicine and medical devices, modular or manufactured homes, and certain pieces of manufacturing equipment.

How do I get sales tax exemption in Wisconsin?

To apply for exempt status, the State of Wisconsin requires that you complete Wisconsin Department of Revenue Form S-211 (Wisconsin Sales and Use Tax Exemption Certificate). The effective date of the sales tax exemption is the date the form is signed. We cannot determine your taxable status.

What is a E 595E form for?

North Carolina Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, is to be used for purchases for resale or other exempt purchases.

Can you file exempt in Wisconsin?

You may claim exemption from withholding of Wisconsin income tax if you had no liability for income tax last year, and you expect to incur no liability for income tax this year. To claim complete exemption from withholding use Wisconsin Form WT-4, Employee's Wisconsin Withholding Exemption Certificate.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my wisconsin sales tax exempt form in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your what is the state of the document described in s and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send sales tax exemption form wisconsin for eSignature?

Once you are ready to share your wisconsin farm tax exempt form, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I execute wisconsin tax exempt certificate online?

Easy online wi tax exempt form pdf completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

What is Wisconsin tax exempt form?

The Wisconsin tax exempt form is a document used by certain organizations to claim exemption from sales and use tax in the state of Wisconsin.

Who is required to file Wisconsin tax exempt form?

Organizations such as nonprofit entities, religious institutions, and government bodies that qualify for sales and use tax exemption are required to file the Wisconsin tax exempt form.

How to fill out Wisconsin tax exempt form?

To fill out the Wisconsin tax exempt form, organizations must provide details such as their name, address, and tax identification number, as well as indicate the basis for their tax-exempt status and provide any necessary supporting documentation.

What is the purpose of Wisconsin tax exempt form?

The purpose of the Wisconsin tax exempt form is to establish that an organization is eligible for exemption from sales and use tax, thus allowing them to make purchases without incurring tax.

What information must be reported on Wisconsin tax exempt form?

The information required on the Wisconsin tax exempt form includes the organization's name, address, tax identification number, type of tax-exempt status, and any relevant supporting information demonstrating eligibility for exemption.

Fill out your wisconsin tax exempt form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Exempt Form Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to blank tax exempt form

Related to wisconsin sales tax exemption lookup

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.