Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax exempt form pdf?

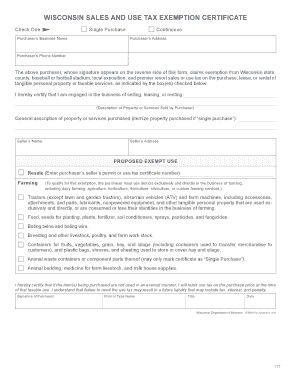

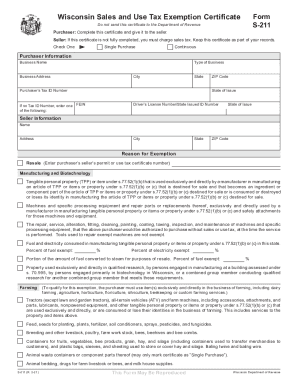

A tax exempt form PDF is a document that allows certain organizations or individuals to make purchases without paying sales tax. It is typically issued by the government or tax authorities to provide proof of tax-exempt status. The tax exempt form PDF can be filled out online or downloaded and printed, and it is used by the purchaser to claim an exemption from sales tax when making qualifying purchases.

Who is required to file tax exempt form pdf?

There are several types of organizations or individuals who may be required to file a tax exempt form (Form 1023) with the Internal Revenue Service (IRS) in the United States. These may include:

1. Nonprofit organizations: Charitable, religious, scientific, literary, educational, or other organizations that operate for tax-exempt purposes may need to file a tax exempt form.

2. Churches and religious organizations: Even though churches and religious organizations are automatically considered tax-exempt, they may still choose to file Form 1023 to confirm their status and enjoy certain benefits.

3. Political organizations: Organizations engaging in political activities may seek tax-exempt status and file Form 1023, such as political action committees (PACs) or political parties.

4. Social clubs: Social, recreational, or similar organizations that meet certain criteria for tax-exempt status may be required to file Form 1023.

5. Employee associations: Organizations formed to provide benefits to a group of employees, such as unions or employee-owners associations, may need to file for tax-exempt status if they meet the criteria.

6. Exempt charitable trusts: Certain types of charitable trusts that meet specific criteria may need to file Form 1023 to establish tax-exempt status.

It is important to consult the IRS or a tax professional to determine if filing a tax-exempt form is necessary for a specific organization or individual situation, as the requirements can vary.

How to fill out tax exempt form pdf?

To fill out a tax exempt form PDF, you can follow these steps:

1. Open the PDF file using a PDF reader, such as Adobe Acrobat Reader or any other program capable of editing PDFs.

2. Make sure you have all the necessary information and documents handy.

3. Begin by reading the instructions on the form to understand what information is required.

4. Click on the fields within the form to activate them for editing.

5. Starting from the top of the form, enter your organization's name, contact details, and tax identification number, if applicable.

6. Provide any additional information requested, such as the date and purpose of the exemption, as well as any supporting documentation required.

7. If there are checkboxes on the form, click on them to indicate your selection or fill them by typing "X" in the appropriate fields.

8. If there are calculations involved, use the "Calculator" function within the PDF software or calculate manually and enter the results.

9. Review the completed form to ensure all information is entered accurately.

10. Save a copy of the filled-out form for your records or print it if required.

11. If the form requires signatures, print the form, sign it, and submit it according to the instructions provided with the form.

Remember, specific instructions may vary depending on the tax exempt form you are filling out, so it is always important to carefully read the instructions provided with the form before proceeding.

What is the purpose of tax exempt form pdf?

Tax exempt form PDFs are used to claim exemption from certain taxes or to establish eligibility for certain tax benefits. These forms are issued by governmental authorities and are typically used by non-profit organizations, government entities, or individuals who qualify for tax exemptions.

The purpose of tax exempt form PDFs can vary depending on the specific tax laws and regulations of a particular country or jurisdiction. Some common purposes of tax exempt form PDFs include:

1. Exemption from sales tax: Non-profit organizations or government entities may use tax exempt form PDFs to obtain exemption from paying sales tax on purchases made for their exempt purposes, such as educational institutions, hospitals, or charitable organizations.

2. Income tax exemption: Certain individuals or organizations, such as religious institutions, charitable foundations, or agriculture-related bodies, may use tax exempt form PDFs to establish their eligibility for income tax exemption and to report their income and expenses accordingly.

3. Property tax exemption: Tax exempt form PDFs can be used to claim exemption from property taxes for properties owned by certain organizations or individuals with specific qualifications, such as religious or educational institutions or government bodies.

4. Exemption from excise taxes: Tax exempt form PDFs can be used by eligible entities to claim exemption from excise taxes on specific goods or services, such as fuel, certain agricultural or industrial activities, or medical supplies.

In summary, tax exempt form PDFs serve the purpose of establishing eligibility for tax exemptions or benefits and ensuring that qualifying individuals or organizations are not subject to certain taxes based on their specific circumstances or activities.

What information must be reported on tax exempt form pdf?

The specific information that must be reported on a tax exempt form PDF may vary depending on the jurisdiction and the type of tax exemption being sought. However, some common information required on tax exempt forms may include:

1. Organization details: Name, address, and contact information of the tax-exempt organization.

2. Tax identification number: The tax identification number, such as an Employer Identification Number (EIN), for the organization.

3. Organizational structure: Details about the organization's legal structure, mission, and activities.

4. Financial information: Information about the organization's finances, including revenue sources, expenses, assets, and liabilities.

5. Tax year: The fiscal year for which the tax exemption is being sought.

6. Exempt purpose: A description of the organization's exempt purpose and how it meets the criteria for tax-exempt status.

7. Activities conducted: Details about the organization's activities, including any fundraising, lobbying, or political activities.

8. Public support: Information about the organization's sources of public support, such as donations, grants, or membership dues.

9. Compensation and benefits: Details about the compensation and benefits provided to the organization's officers, directors, and key employees.

10. Attachments and supporting documents: Depending on the specific requirements, supporting documents may need to be attached, such as financial statements, articles of incorporation, bylaws, or sample contracts.

It is important to consult the specific tax regulations and requirements of the relevant jurisdiction and seek professional advice or guidance to ensure accurate and complete reporting on tax exempt forms.

When is the deadline to file tax exempt form pdf in 2023?

The exact deadline to file tax exempt form PDF in 2023 may vary depending on the specific country and tax laws. Please provide more details regarding the country or jurisdiction for a more accurate response.

What is the penalty for the late filing of tax exempt form pdf?

The penalty for late filing of a tax exempt form (such as Form 990 for tax-exempt organizations in the United States) can vary depending on the specific circumstances and jurisdiction. Generally, the IRS imposes a penalty of $20 per day for each day the return is late, up to a maximum penalty of $10,000 or 5% of the organization's gross receipts, whichever is less. However, if the organization can show a reasonable cause for the delay, the penalty may be waived or reduced. It is advisable to consult the appropriate tax authorities or a tax professional for accurate and specific information regarding penalties for late filing of tax exempt forms.

How do I modify my wisconsin tax exempt form pdf in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your wisconsin tax exempt form 2023 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send tax exempt form pdf for eSignature?

Once you are ready to share your printable tax exempt form for wisconsin, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I execute wisconsin govermenet tax exempt form blank online?

Easy online wisconsin sales and use tax exemption certificate form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.